- Why do all cryptocurrencies rise and fall together

- Do all cryptocurrencies use blockchain

- Are all cryptocurrencies the same

List of all cryptocurrencies

Cryptocurrency is only the tip of the iceberg. Use cases for blockchain are expanding rapidly beyond person-to-person exchanges, especially as blockchain is paired with other emerging technologies aussie play casino review. Examples of other blockchain use cases include the following:

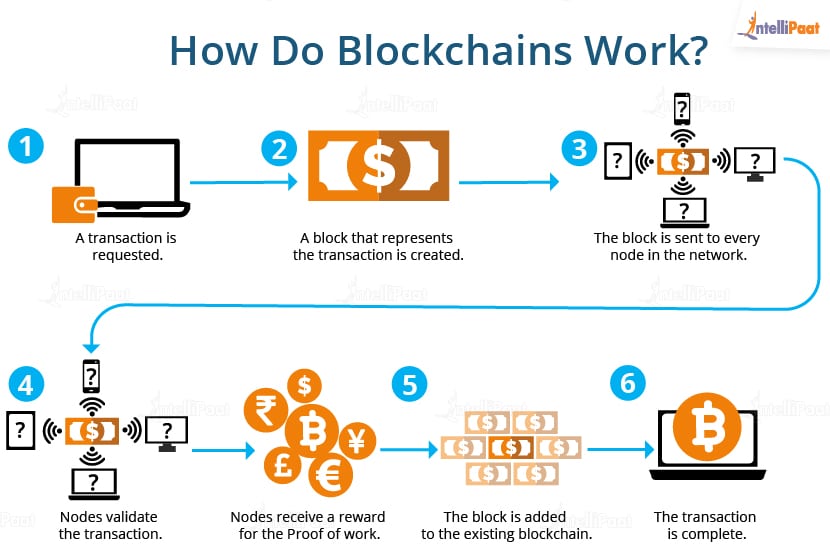

The decentralized nature of the blockchain network ensures that no single entity controls the system, allowing for a secure and transparent system that supports the cryptocurrency network. Blockchain provides the infrastructure that supports the cryptocurrency network, ensuring the integrity and accuracy of all transactions.

All digital assets, including cryptocurrencies, are based on blockchain technology. Decentralized finance (DeFi) is a group of applications in cryptocurrency or blockchain designed to replace current financial intermediaries with smart contract-based services. Like blockchain, DeFi applications are decentralized, meaning that anyone who has access to an application has control over any changes or additions made to it. This means that users potentially have more direct control over their money.

Using blockchain in the financial industry can make transactions more efficient. Visa has shown the efficacy and potential of blockchain technology for mainstream use since adopting it for international business payments in 2017.

Why do all cryptocurrencies rise and fall together

Bitcoin’s decentralized nature and limited supply make it an appealing hedge against inflation. Unlike fiat currencies, Bitcoin operates without counterparty risk, offering a secure store of value. Historical data shows that rising sovereign risk often correlates with increased Bitcoin adoption. For example:

Inflation and interest rates directly impact cryptocurrency prices. When inflation rises, traditional currencies lose value, prompting investors to seek alternative assets like Bitcoin. However, the relationship isn’t always straightforward. For example, Bitcoin’s price reacts differently depending on inflation levels:

BTC’s stature as the first commercial crypto and the specific traits mentioned above determine its value. As of 4 December 2022, it enjoys a market dominance of 38.27%, making the entire crypto space respond to its price movements.

Cryptocurrencies, especially Bitcoin, have shown a correlation with traditional markets like the S&P 500. These markets are influenced by macroeconomic factors such as inflation rates, GDP growth, and unemployment rates. Therefore, when these factors affect traditional markets, they also impact the cryptocurrency market, leading to a coordinated movement.

The cryptocurrency market operates 24/7, making it a breeding ground for FOMO (fear of missing out) and fear-driven sell-offs. FOMO occurs when investors rush to buy an asset, fearing they’ll miss out on potential gains. This behavior often drives prices higher in the short term. Conversely, fear-driven sell-offs happen when investors panic and sell their holdings, leading to sharp price declines.

Do all cryptocurrencies use blockchain

Not all cryptocurrencies use blockchain technology, but most do. This is because blockchain technology is a fundamental component of most cryptocurrencies, providing a secure and decentralized way to record transactions.

Each of them puts into practice a different consensus algorithm. Nano, formerly called Raiblocks, implements the so-called Block-lattice. With Block-lattice, every user gets their own chain to which only they can write. Additionally, everyone holds a copy of all of the chains. Every transaction is broken down into a send block on the sender’s chain, and a receive block on the receiver’s chain. The problem of Block-lattice is that it is vulnerable to penny-spending attacks. These involve inflating the number of chains that nodes must track by sending negligible amounts of cryptocurrency to empty wallets.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies like the dollar or euro, cryptocurrencies are decentralized and operate on blockchain technology. The most well-known cryptocurrency is Bitcoin, but there are thousands of others, including Ethereum, Ripple, and Litecoin.

Understanding Altcoins Altcoins belong to the blockchains they were explicitly designed for. Many are forks—a splitting of a blockchain that is not compatible with the original chain—from Bitcoin and Ethereum.

Not all cryptocurrencies use blockchain technology, but most do. This is because blockchain technology is a fundamental component of most cryptocurrencies, providing a secure and decentralized way to record transactions.

Each of them puts into practice a different consensus algorithm. Nano, formerly called Raiblocks, implements the so-called Block-lattice. With Block-lattice, every user gets their own chain to which only they can write. Additionally, everyone holds a copy of all of the chains. Every transaction is broken down into a send block on the sender’s chain, and a receive block on the receiver’s chain. The problem of Block-lattice is that it is vulnerable to penny-spending attacks. These involve inflating the number of chains that nodes must track by sending negligible amounts of cryptocurrency to empty wallets.

Are all cryptocurrencies the same

Tether is a stablecoin, or a currency tied to a fiat currency — in this case, the U.S. dollar. The idea behind Tether is to combine the benefits of a cryptocurrency (such as no need for financial intermediaries) with the stability of a currency issued by a sovereign government (vs. the wild price fluctuations inherent with many cryptos).

Some examples of digital currencies include cryptocurrencies, stablecoins, and Central Bank Digital Currencies. Interestingly, CBDCs are a common highlight in every digital currency vs cryptocurrency comparison as they are the most credible form of digital currency. CBDCs are a type of digital currency issued by the government or national monetary authority of a country.

As a conclusion to all the things we mentioned in this article, we can say that the crypto market has a huge potential to be even bigger in the future. All of these differences are normal and expected, and of course, it’s on us to decide if we will take a part in this or not.

The fiat-crypto rates are changing and we can’t expect that they will stay the same all the time, because the crypto market has a different dynamic than the global financial system. For example, Bitcoin is now going close to $13,000 per one coin, but one Litecoin is equal to $56, and one Ether is $412. There is some crypto money that is related to the traditional currencies too. This is another one thing that shows us how different are these currencies, but also, that we can’t expect the situation will be the same forever. Maybe one day some of the smaller currencies will have a chance to be huge as the Bitcoins.

The information contained herein neither constitutes an offer for nor a solicitation of interest in any specific securities offering. For any proposed offering pursuant to an offering statement that has not yet been qualified by the SEC, no money or other consideration is being solicited, and if sent in response, will not be accepted. No offer to buy the securities can be accepted and no part of the purchase price can be received until the offering statement for such offering has been qualified by the SEC any such offer may be withdrawn or revoked, without obligation or commitment of any kind, at any time before notice of acceptance given after the date of qualification. An indication of interest involves no obligation or commitment of any kind. Offering circulars for Masterworks offerings are available here.